Your credit rating, the quantity you to definitely loan providers used to imagine the possibility of stretching your credit or lending you money, is actually a key cause of deciding whether or not you’re recognized for home financing. The fresh new score isn’t really a predetermined number but varies sometimes in response in order to alterations in the credit passion (such as for example, if you unlock another type of credit card account). ? ? Just what count is right adequate, as well as how create score dictate the interest rate youre given? Keep reading to ascertain.

Trick Takeaways

- Overall, a credit rating over 670 enables potential financial borrowers availability so you can primary or favorable interest levels on their loan. ? ?

- Results below 620 are believed getting subprime, and you may come with higher rates of interest and more constraints because of its greater risk to help you loan providers. ? ?

- To help you be eligible for a reduced downpayment FHA-recognized loan, needed no less than a good 580 FICO credit history. ? ?

- Those with tough borrowing may still be get to acquire an excellent financial out-of specialty lenders but pays higher still cost, need large downpayments, may need an excellent guarantor otherwise co-debtor, and get subject to income Hudson South Dakota unsecured personal loans for fair credit confirmation. ? ?

How Was Credit scores Calculated?

Widely known credit rating is the FICO score, which was developed by Fair Isaac Company. ? ? Its calculated with the adopting the different items of study out of your credit history:

- The commission background (and that represents 35% of your own rating)

- Wide variety you owe (30%)

- Amount of your credit history (15%)

- Variety of borrowing you employ (10%)

- The brand new borrowing from the bank (10%) ? ?

What’s the Lowest Credit score to help you Qualify for a mortgage?

There isn’t any official lowest credit history just like the lenders can be (and would) simply take other variables into consideration whenever choosing for folks who be eligible for a mortgage. You will end up acknowledged to own a mortgage with a reduced borrowing rating if the, particularly, you have got a good downpayment otherwise the debt stream try if you don’t low. Because so many lenders see your credit rating once the just one piece of mystery, a reduced rating won’t necessarily stop you from taking home financing.

Just what Loan providers Like to see

Since there are certain credit ratings (per centered on a different sort of rating program) available to lenders, make sure you learn which get their lender is utilizing very you could contrast apples to help you oranges. A score regarding 850 is the highest FICO rating you could score. ? ? For every single lender comes with its method, therefore when you are one financial can get approve your financial, other elizabeth credit history.

If you are there are not any community-wider standards to have credit ratings, the following level from private fund studies webpages functions as an excellent starting point for Credit scores and you may what each assortment opportinity for getting a home loan:

580620: Subprime borrowing You are able to have consumers to find a home loan, although not guaranteed. Conditions will be undesirable. ? ?

300580: Bad credit There can be little to no chance of providing a home loan. Consumers would have to do something to evolve credit score in advance of being qualified. ? ? ? ?

FHA Funds

The newest Government Construction Management (FHA), that’s area of the U.S. Agency out-of Houses and you will Metropolitan Creativity, even offers money which can be supported by government entities. ? ? Generally, the financing requirements to have FHA money are more casual compared to those to have antique loans. In order to qualify for a reduced advance payment home loan (currently 3.5%), you’ll need a minimum FICO rating from 580. If for example the credit score falls below you to definitely, you can nonetheless get a home loan, however you will need to establish no less than 10%. ? ?

Rates of interest and your Credit history

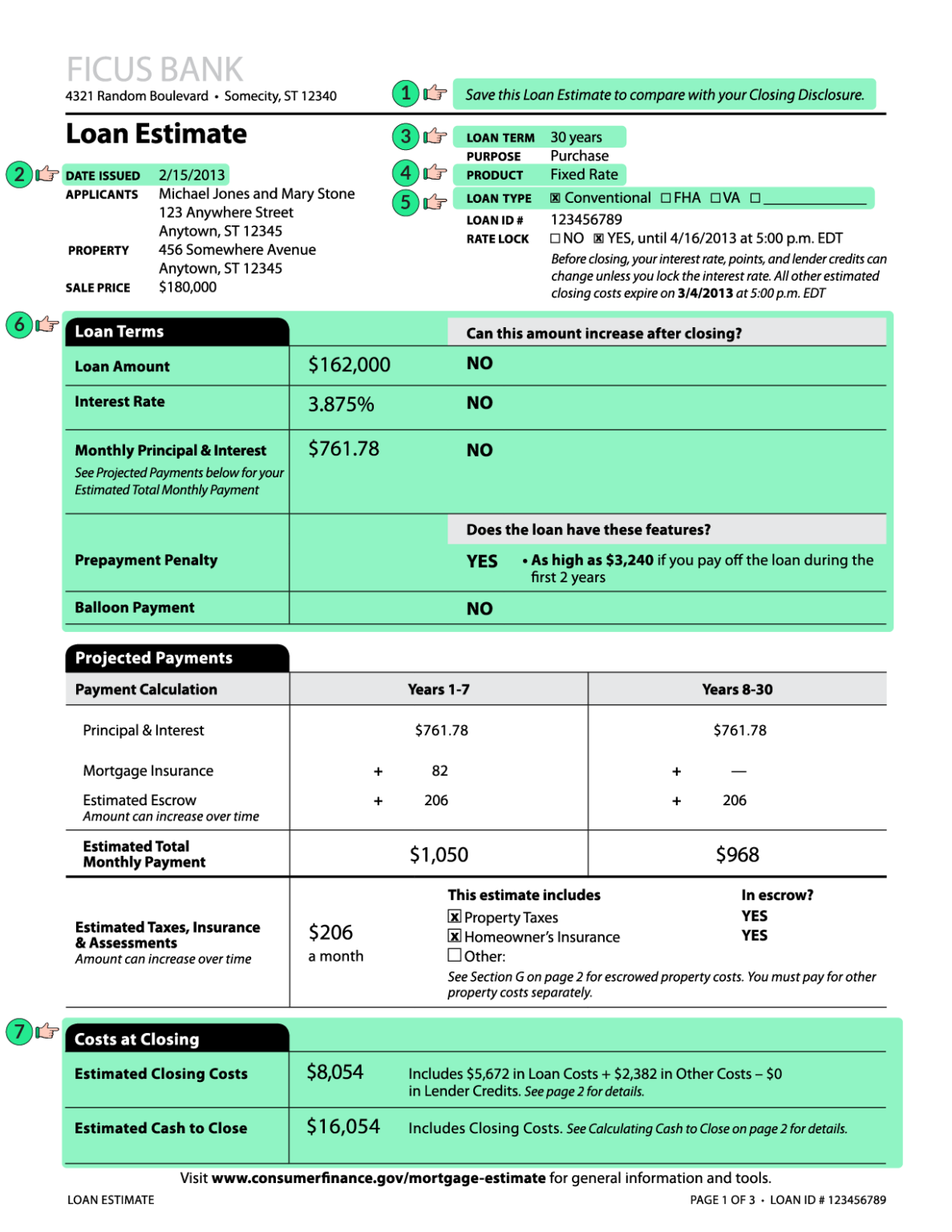

Whenever you are there’s no certain algorithm, your credit rating affects the speed you have to pay on your own mortgage. As a whole, the higher your credit rating, the low your own interest, and you can the other way around. This may have a massive affect both their monthly payment together with amount of desire you have to pay across the longevity of the loan. Here’s an example: Imagine if you earn a 30-season fixed-rate home loan to possess $200,000. If you have a high FICO credit score-particularly, 760-you can find mortgage regarding step 3.612%. At this speed, the payment would be $, and you may might end purchasing $127,830 in the notice along side 30 years.

Make same loan, however you have got a lowered credit rating-say, 635. Their interest jumps to 5.201%, which can perhaps not seem like an improvement-if you don’t crisis the latest amounts. Now, their monthly payment was $step 1, ($ a great deal more every month), along with your complete attention with the mortgage are $195,406, otherwise $67,576 more the loan into high credit rating. Home financing calculator can show the perception of different rates on your payment per month.

It’s always smart to alter your credit rating prior to trying to get a mortgage, and that means you get the best terms and conditions you are able to. Needless to say, it does not constantly work-out this way, but if you feel the time and energy to carry out acts like see your credit history (and you may enhance one mistakes) and you will pay down debt before applying for a mortgage, it will almost certainly pay off finally. For much more notion, you may want to take a look at an educated an effective way to rebuild your own credit score rapidly, or just an educated a means to fix a woeful credit score. Rather, without having committed to solve your credit rating, it would be worthy of exploring one of the better credit fix people to get it done to you.

The conclusion

Although there is not any official minimum credit score, it’ll be easier discover home financing in case the get was higher-and terms and conditions can be top, as well. Since the majority individuals have a score of each of the big three credit agencies-Equifax, Experian, and you will TransUnion-loan providers often pull a great tri-merge credit history that features score off all three enterprises. ? ? When the all of the three fico scores are practical, the guts rating try what is actually known as representative score, or the one that’s made use of. If perhaps one or two ratings are usable, the reduced you’re utilized. ? ?

You can purchase initial information on where you stand at no cost. Annually, you are permitted you to definitely 100 % free credit file of all of the top around three credit reporting agencies. ? ? Getting a totally free credit rating is far more difficult, you could get your credit score away from a financial, many of which try increasingly leading them to readily available, otherwise regarding websites that provide its 100 % free credit scores. ? ?