USDA fund are very best for straight down-income otherwise straight down borrowing customers whilst helps them achieve the imagine homeownership if they’re happy to get home inside the state otherwise outlying section. This type of financing aren’t available in cities however, would offer the possibilities for all those wishing to purchase homes a beneficial nothing from the beaten highway. This USDA financing FAQ was created to support you in finding the new solution to multiple frequently asked questions about such novel fund.

Are merely very first-date homeowners eligible?

But not, such money is actually entirely getting owner-filled services which means you need certainly to either offer your existing home if owned otherwise bring proof your house is no longer appropriate for your needs (we.elizabeth. too much away from your current work, too little for the broadening family relations, etcetera.).

What’s the limitation matter that we can be obtain?

The utmost amount borrowed for USDA finance is dependent upon new area where property is receive. As an example, homes in the most common off Alabama has an optimum loan worth of $265,400 by 2020 whenever you are financing when you look at the Anchorage, Alaska maximum out within $449,100 or has an optimum loan property value $615,000 in North park, California.

Exactly how much may be the settlement costs to own a beneficial USDA home loan?

Closing costs was cutting-edge things. This is actually the instance although taking out fully a beneficial USDA home loan loan. I don’t have a great unilateral you to definitely-size-fits-all matter that is obtained from consumers as closing costs. Instead, you can rely on certain charge and costs as incorporated on your own settlement costs, including:

- Mortgage origination costs.

- Administrative and/otherwise underwriting costs.

- Escrow costs.

- Name charges.

- Signing charge.

- County recording costs.

- Other sundry costs having things like credit reports, bank fees, appraisal will cost you, etc.).

The good thing to possess individuals is the fact that closing costs having USDA mortgage loans is covered to your financing and query providers to blow part of the closing costs.

What is the USDA loan be sure?

There are 2 variety of USDA home loans. You’re the fresh USDA head loan and the most other ‘s the USDA protected loan. The brand new secured loan gets the exact same lowest credit rating element 640 however, offers high earnings limits and you may eliminates limit family size limit that USDA lead funds demand.

Perform USDA lenders want off costs?

USDA home loans do not require down payments. That isn’t to state that you simply can’t generate off money when buying USDA house. The reality is that by giving a down-payment you are automatically building escrow of your property, reducing monthly installments, and reducing the complete number might eventually purchase the latest domestic. Regardless of if off money commonly required, he could be strongly suggested.

How can i verify that my home is USDA-qualified?

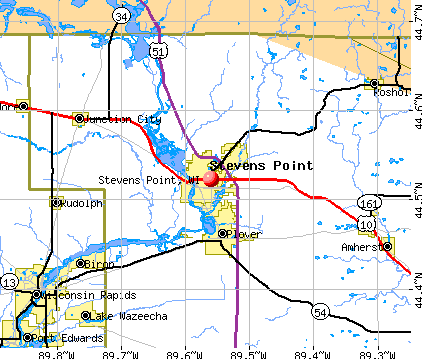

The usa Department regarding Farming maintains an internet site which provides qualifications factual statements about functions. Just stick to the tips detailed right here (predicated on property sorts of) to choose in case your property can be entitled to USDA money.

Try a beneficial USDA loan hard to get?

In the event you meet the financial and you may credit conditions out of USDA financing, they are not one to difficult to get into qualifying characteristics. People in some communities could have problem interested in services one meet the fresh certificates to have a particular version of USDA loan from assets dimensions, location, or perhaps the condition of the home.

USDA mortgage brokers render of numerous possible advantageous assets to homebuyers that do not meet with the borrowing criteria for the business loans for truck drivers majority old-fashioned funds or even for people who may lack the funds having a big downpayment toward a home. You think the newest USDA loan could be the best choice to you? Get in touch with Mid america Mortgages right now to discover more to check out if you are qualified.