Self-employed Home loan

Brand new liberty of being self employed is priceless, but self employed mortgage options would be difficult to find. Usually vehicles or any other financial institutions keep in mind that you might not end up being appearing much internet profit once the at all whenever you can stop investing fees to the earnings thinking about? In terms personal load with no loan origination fee of to invest in property yet not, their come a new tale. There were an incredible importance of one-man shop home loan options and you can we have now him or her. Given that a loan provider we all know and you will understand your own genuine money you’ll not mirror the caliber of way of living that your particular net gain for the your own tax returns you’ll reveal, so we currently have one-man shop home loan alternatives for one to use and you can we hope take advantage of. Commercially an one-man shop debtor is also make use of people financing system offered, including Old-fashioned, USDA, Va, and you will FHA money, but if you are unable to qualify situated away from just what reveals to the their tax returns you have to know oneself functioning financial alternatives.

Conventional Self-employed Home loan

Prior to using an alternative self employed financial making sure your can’t use antique funding is essential to accomplish. If you’ve been self employed for around five years have a tendency to due to Freddie Mac we can score a self employed borrower acknowledged using only the latest income tax get back. That’s important since or else you would need a couple of years out-of taxation efficiency together with underwriter perform mediocre the funds anywhere between both of these age. If you experienced a present seasons, or if you package to come together with your CPA your own most recent tax statements you certainly will work obtaining your approved to possess an one-man shop home loan utilizing old-fashioned financing. The minimum off was 5% however, its potential brand new automated underwriting results you will wanted a lot more down in order to qualify for bringing precisely the most recent year.

Self-employed Financial Financial Report System

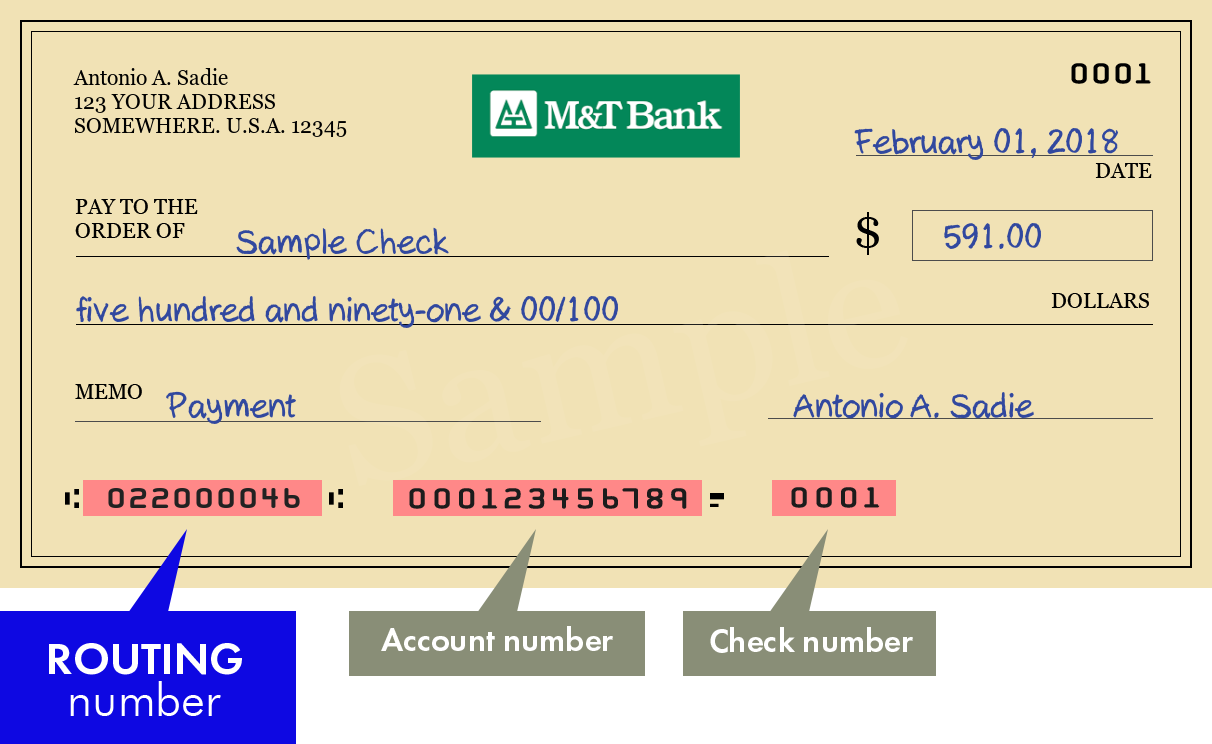

If you’ve been one-man shop for at least couple of years its potential we can use your bank comments so you can qualify for a mortgage. Sometimes 12 months of one’s own bank statements otherwise one year of one’s providers lender comments. Just your places was determined to possess earnings so that the debits or net balance aren’t useful for earnings computation. Your own rating need to be an effective 600 in order to meet the requirements and you’ve got for at least ten% off. This choice are used for first houses, 2nd house, or financial support properties. We would’t even look at the taxation statements. Your debt that presents upon their borrowing from the bank and just about every other possessions possessed could well be used in the debt ratios which have a good maximum around 50%. This is an excellent self employed financial system and has now protected of many sale in which self employed consumers couldn’t get a hold of resource elsewhere. Visit here to possess information on all of our lender declaration home loan system.

Self-employed Home loan Debt Calculations

In the event that using old-fashioned or any other regulators mortgage system it’s important to remember that in case figuring the debt rates given that a personal working debtor there are specific facts we can add back into to own practical money. This is the circumstances for making use of antique and other money means as well as a bank statement mortgage program otherwise a stated money system. For example if you use a timetable C following a good percentage of their distance deduction might be extra back in just like the practical income, and you may depreciation, along with a portion of two other activities. Their important to features an expert capture an extra check the taxation statements when the that loan inventor enjoys said you to you don’t generate sufficient money. You can find choices available and the quantity of nuance during the terms of the rules getting self-employed mortgages is pretty detailed. In addition for those who have an effective K-1 regarding a firm you own otherwise was region owners of, in the event that there was a serious once deduction which may be safely recorded this is simply not planning to occurs once more on the predictable upcoming, which is often extra back to just like the practical income.