- When rates is dropping, and safe less rates so you can cut toward interest

- If for example the borrowing is significantly better than once you got your own mortgage, you could potentially refinance having a far greater price

- If you wish to pay-off your loan less, you might alter the loan conditions (30-year fixed to 15-12 months fixed, etcetera.)

- When you need to change your loan sorts of (from a changeable-rates mortgage to a predetermined price, etc.)

- When you want to eradicate somebody’s term on the identity

- When you need dollars to possess a home improvement venture or even combine financial obligation

Different varieties of Refinance

When you re-finance financing, there are various methods you could potentially go about it, based as to why you’re refinancing. Let’s go over a few different varieties of re-finance.

Rates And you may Title Re-finance

A speeds and you may term re-finance is a type of refinance you to allows you to replace the regards to your own past financing in order to ones which can be a great deal more favorable for you. You would usually do a rate and you can term re-finance to reduce the rate of interest, payment per month otherwise reduce their repayment title.

Cash-Aside Refinance

Once you make your monthly home loan repayments, your generate equity inside your home over time. A funds-away refinance is a type of refinance that allows you to definitely withdraw some funds out of your home guarantee to use Woodstock money loans for another objective. Any time you you prefer currency in order to remodel your home otherwise buy another significant circumstances, an earnings-out refinance makes you obtain from the money.

When you cash out security, you can get the difference between your home loan balance while the appraised well worth when it comes to bucks. By way of example, you can even owe $225,100000 and you also re-finance to own $three hundred,one hundred thousand. If that’s the case, might found $75,100000 for the cash that you can use getting whatever you you want from investment a beneficial kid’s college degree so you can installing a brand name-the latest kitchen.

It’s sweet to get some explore from your own greatest money, although disadvantage away from a cash-out re-finance is that you are and work out costs expanded simultaneously so you can expenses a whole lot more inside the attract if you find yourself stretching out the word of financing.

Combination Refinance

A great integration refinance isnt its very own sort of refinance, but instead a specific use of a finances-aside re-finance. For those who have a good amount of higher-appeal loans, such credit card debt, you can make use of an earnings-aside re-finance to settle each one of these expense and you may consolidate the debt into the financial, which has a reduced interest rate. In that way, you may be generally lumping all your expenses to your one to commission which have an effective more effective interest.

Home Refinance Choices

Dependent on which your home loan are backed by or bought from the, there could be different options in addition to stuff you has actually to consider when you re-finance. Let’s read some of the variations temporarily.

Traditional Mortgage Re-finance

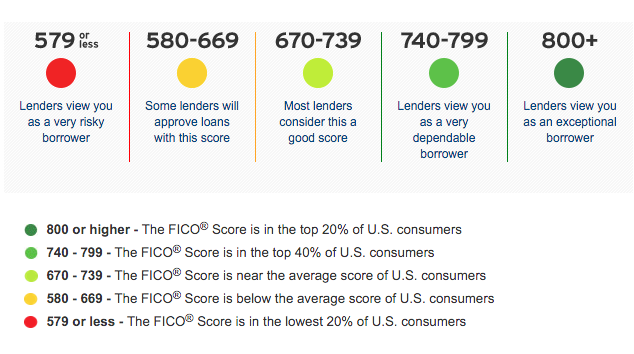

A conventional financing try that loan that fits the requirements of Freddie Mac and you may Fannie mae, the federal government-paid enterprises one to pick mortgages and sell them to buyers. To refinance a normal financing, you generally you would like the very least FICO Get out of 620 and an optimum DTI away from 65%. There can be extra conditions about how large or small their refinanced financing would be predicated on their county’s financing restrict.

Antique financing refinances allows you to reduce your interest rate or change your term when you yourself have as low as step 3% 5% established equity to possess a single-unit priount out of collateral needed could be large.